Jeff Clark | Aug 24th 2020, 6:52:44 pm

It blew up my phone. It was after market hours on Friday, August 14 when the news broke that Berkshire Hathaway’s 13F showed it had purchased 20.9 million shares of Barrick Gold, the largest gold miner in the industry. It caught many gold investors by surprise, myself included, since Buffet has been so negative on gold—even though he bought a miner one wouldn’t do that if they thought gold was headed lower anytime soon.

Editor’s Note: It wasn’t just Warren Buffett’s company buying $565 million worth of Barrick Gold last quarter. That was the big headline, but institutional investors buying gold last quarter was more widespread than just Berkshire Hathaway’s purchase. And it’s just getting started. The research below shows just how much cash could flood into the gold industry.

It blew up my phone. It was after market hours on Friday, August 14 when the news broke that Berkshire Hathaway’s 13F showed it had purchased 20.9 million shares of Barrick Gold, the largest gold miner in the industry.

It caught many gold investors by surprise, myself included, since Buffet has been so negative on gold—even though he bought a miner one wouldn’t do that if they thought gold was headed lower anytime soon.

But as it turned out, the bombardment on my phone about Buffett’s Big Buy was just the tip of the golden iceberg; he was not alone. This is significant, because by all appearances the shift into gold (and silver) by institutional investors has only just begun—they don’t typically take large positions for just one quarter, but invest in what they believe is a trend.

This demanded some research. Just how big could this shift be? How much cash could realistically enter the gold market from these types of investors? And what might it do to the price?

The results of our research below is compelling—if you’re a gold and silver investor. If you’re not, or you don’t have a meaningful stash, consider what impact the whale of institutional cash might have on the minnow-sized gold market… and if it might be time to pick up some ounces in the next dip.

First, let’s review what some institutional investors did last quarter…

Unbeknown to many investors, in addition to Warren Buffett, a plethora of hedge funds entered the gold (and silver) market in the second quarter.

As you can see, it wasn’t just Buffett’s $565 million purchase of Barrick last quarter. Numerous other hedge funds apparently see what Warren sees: an environment ripe for big profits from gold.

But there’s a bigger impact that Berkshire Hathaway’s entrance into the gold market will have: the message it sends to the market…

His purchase removes the “gold is bad” stigma for investors, essentially opening the door for more generalist investors to move into this industry. Buffett is one of the most well-known investors in the world, so other investors are sure to follow.

By the way, we can’t help but point out that gold has outperformed Warren Buffett’s stock over the past 20 years. From July 2000 through July 2020, Berkshire Hathaway shares have risen 433%, but gold has risen 610%. I don’t kid myself that he read my open letter to him, but isn’t it interesting that you and I invested in gold ahead of one of the world's most successful investors?

By all appearances, institutional investors are just now starting to enter the gold market. If other funds follow, what kind of cash could enter this tiny sector?

Hold on to your coffee mug, because the numbers you’re about to see are staggering.

We’ve talked before about how small the gold market is, so we know it is dwarfed by the amount of cash the institutional world has at its disposal.

How dwarfed? Here’s a tally of the AUM (assets under management) for some of the most common institutional investor groups, compared to the TOTAL known above-ground investment-grade ounces of gold, along with 2019’s investment demand.

The amount of AUM from these investor groups dwarfs the amount of investment gold bought all of last year (far right bar).

It also trumps the total amount of known gold investment holdings. If you were to tally up all this cash and compare it to gold—well, an excel doc couldn’t capture it.

But this contrast is further deceiving, because in a bull market most investors will buy gold, not sell. In other words, many of the ounces currently in circulation will not be available for purchase. It’s not inconceivable that some of these investors could even spark a bidding war to get what they want.

So how much gold might institutions want to buy? A general rule of thumb for large institutions like pension funds and insurance companies is to devote 2% of their AUM to any one investment idea. Hedge funds might devote a higher percentage, depending on their mandate; 5% or more would not be uncommon for the more aggressive funds.

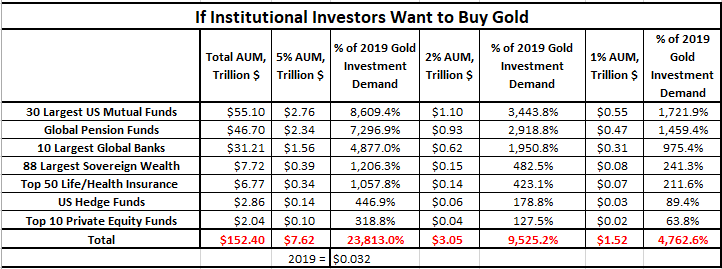

Here’s the percentage of last year’s investment demand (16.6 million ounces) these groups would gobble up if they devoted 5%, 2%, and 1% of their cash to gold.

The red row along the bottom shows the percentage above last year’s investment in gold that each category would exceed. For example, if institutional investors devoted 5% of their AUM to the physical gold market, it would be 23,813% MORE than all the gold bought by investors last year. A lousy 1% would exceed last year’s demand by 4,762.6%.

Heck, the pension industry alone would buy more than 1,349% of last year’s coins and bars than were minted. With just 1% of their cash.

The conclusion here is pretty obvious: there’s not enough gold for these groups to buy anywhere near even a 1% level. And keep in mind that the table isn’t even a comprehensive list of institutional investors. There’s clearly not enough gold to go around.

If institutional investors as a group wanted 2% exposure to gold, it would be 95 times more than the amount of gold that went to investment last year. It would look something like this.

Yes, that graphic is to scale.

Not every fund will want gold, of course, and some will prefer mining equities, and some couldn’t buy gold (a dedicated bond fund, for example). But the reality of the situation is very clear:

The gold industry is so tiny compared to the amount of cash held by institutional investors that it would easily and completely overwhelm it. Gold prices could ignite from this catalyst alone.

In Q1, only about 2% of hedge funds had any gold in their portfolios. In other words, the buying in Q2 outlined above is just the start.

Even though there’s not enough gold for these investors to buy, it won’t keep them from trying, especially as the price climbs higher and higher. They could even start making private deals, offering premiums above the going rate to secure what they want—if that happens it could easily be the start of Unobtainium that Mike has talked about.

Keep in mind that institutional entities have armies of analysts, millions of customers, and trillions of dollars… even just a small tidbit of cash entering the physical gold market could ignite the price like we’ve never seen before. And the higher the price goes, the more they won’t be able to ignore it and the more they’ll clamor for exposure.

We’re in the early stages of gold’s bull market. It’s a stair step—two steps up and one step down, but the direction is up. If you don’t have the number of ounces you want, my advice is to buy on the next step back.

(Follow Jeff on Twitter @TheGoldAdvisor)

***

To view the original version of this article, please visit: https://goldsilver.com/blog/here-come-the-institutional-investorshow-this-shift-could-overwhelm-the-gold-industry/

Your Money is Naked: Five Reasons Everyone Should Store Some Gold Outside Their Home Country—and Where to Do So | Dec 3, 2024

GOLD: Here’s What’s Happening Right Now | May 23, 2023

Gold in Q1: Hello, Banking Crisis | Apr 19, 2023